Men working in finance and insurance are the only group whose income during the pandemic didn’t go down.

Millions of workers across all sectors of the economy were on furlough. Millions more had their hours cut or lost their jobs. But our analysis revealed an important story hidden behind the numbers: how the intersection of gender and class affects how likely you are to have lost work and income during the pandemic, with men in white-collar jobs the least impacted. Notably, men in the finance sector experienced no loss of earnings on average, while women across all sectors and all other men have experienced a loss of earnings on average.

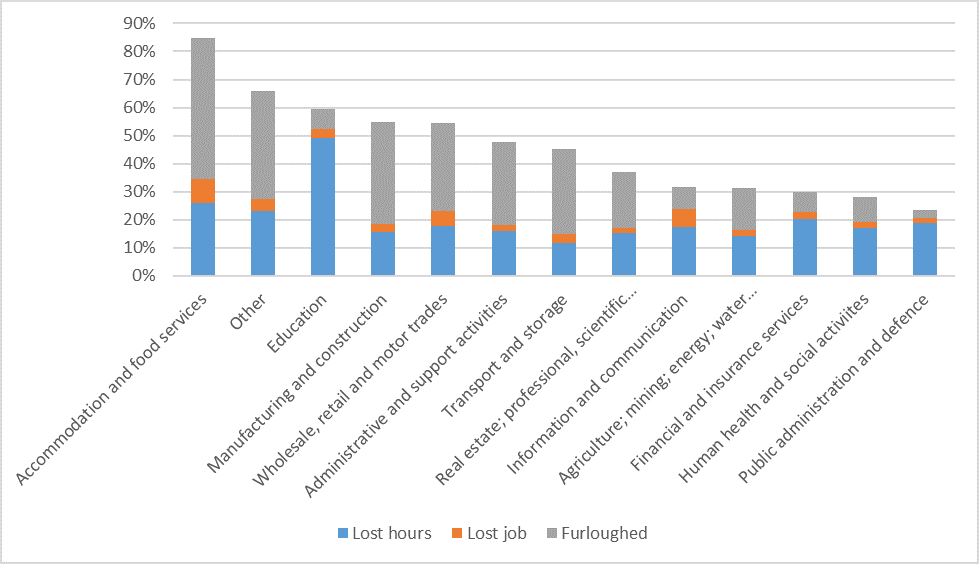

It is not surprising that the people most likely to have been furloughed, lost work, or had their hours cut, work in the accommodation and food services sector, where 85% of workers have been affected. The sector was almost entirely shut down by the government’s lockdown measures. One in four workers in this sector lost hours, one in ten lost their job altogether, and half were furloughed. Other highly affected sectors are: education, with 60% of employees affected and nearly half losing hours; manufacturing and construction (55% affected); and wholesale, retail and motor trades (54% affected).

Figure 1: Workers in public administration and defense, and financial and insurance services were among the workers least affected financially by the crisis

Proportion of employees employed in February 2020 reporting losing hours, losing their job, or being put on furlough in April 2020, by sector

In contrast, other sectors were relatively better protected. Given the demand for health and care services, it’s unsurprising that roles in human health, social activities and public administration faced the lowest number of job cuts. Still, it’s interesting to note that even in these key sectors, around one in five employees were affected. Other sectors, such as financial and insurance services, also experienced less disruption, with one in three (30%) workers affected in some way.

The difference between the impact on men and women

The data confirms that men and women are impacted differently economically. Men and women are equally likely to have lost their jobs, with 4% of those employed in February 2020 reporting they had lost their jobs by April. But men are more likely to have been furloughed (23% of men were furloughed compared to 19% of women overall), while women are more likely to have had their hours cut without being furloughed (18% of men report lost hours compared to 24% of women).

But these figures are not necessarily indicative of the impact that the crisis on peoples’ material wellbeing. To get a more accurate estimate of this, we analysed data on self-reported earnings in February 2020, compared to April. This reveals striking differences in the impact on earnings for men and women across different sectors.

On average, both men and women employed in February 2020 lost approximately 10% of earnings. But notably, on average, men working in the financial and insurance services sector experienced no loss of income. This is not true across any other sector, making men working in finance and insurance services the only group not to have lost income on average. By contrast, men in all other sectors and all women have lost income on average. Average earnings fell the furthest in traditional blue-collar sectors such as manufacturing and construction, and transport and storage, as well as those sectors directly affected by lockdown arrangements, such as accommodation and food services.

Figure 2: Men in financial and insurance services experienced no loss of earnings

Proportion of employees employed in February 2020 reporting losing hours, losing their job, or being put on furlough in April 2020, and change in weekly net income, by sector and gender

These findings add to the extensive evidence base that households experienced the economic shock of Covid-19 very differently, and that the shock is widening deep-seated inequalities, here highlighted by gender and class divides. Men working in white-collar sectors remain relatively insulated from the economic impacts of the crisis, while other workers have seen a loss of earnings. Other research has highlighted that low-income workers, who are more likely to be Black, Asian or minority ethnic (BAME) are disproportionately affected, and that young people in particular are most likely to have lost their jobs.

| Sector | Average change in net weekly earnings, Feb 2020 — April 2020 (all) | Average change in net weekly earnings, Feb 2020 — Apr 2020 (male) | Average change in net weekly earnings, Feb 2020 — Apr 2020 (female) |

| Agriculture; mining; energy; water supply | -4% | -4% | -4% |

| Manufacturing and construction | -10% | -11% | -6% |

| Wholesale, retail and motor trades | -6% | -7% | -4% |

| Transport and storage | -11% | -11% | -20% |

| Accommodation and food services | -21% | -24% | -7% |

| Information and communication | -7% | -7% | -3% |

| Financial and insurance services | -1% | 0% | -5% |

| Real estate; professional, scientific and technical activities | -5% | -7% | -11% |

| Administrative and support activities | -11% | -12% | -5% |

| Public administration and defence | -5% | -5% | -7% |

| Education | -3% | -3% | -3% |

| Human health and social activities | -11% | -5% | -20% |

| Other | -15% | -9% | -10% |

We need recovery measures to consciously work to reverse some of these unequal impacts and reorient our economy to ensure that no one is left behind. This requires large-scale and ambitious approaches that support people who have lost jobs, such as further spending through our social security system to support those who have lost incomes, and large-scale public investment programmes to create new green jobs.

Notes

1. Data used for the analysis is from the Understanding Society Covid-19 study is a monthly survey on the impacts of the Covid-19 pandemic on the UK population, funded by the Economic and Social Research Council (ESRC) and the Health Foundation. The first wave was carried out online between 24 and 30 April. It links to the ongoing Understanding Society survey, the UK Household Longitudinal Survey, which follows tens of thousands of UK households annually to track their socio-economic circumstances and experiences over time. All Understanding Society adult sample members aged 16+ were invited to participate the Covid-19 study, and 17,452 completed the survey in the first wave. For further detail, see here: https://www.understandingsociety.ac.uk/research/themes/covid-19

2. The analysis focusses only on those of working age (18 — 65) who were employed in February 2020, or employed and self employed (ie. it does not consider the unemployed or those who were self employed. We also eliminate those with missing data on key statistics, such as hours worked, earnings, and for whom sector information is unavailable — giving a total sample of 7,504.

3. The Covid-19 study did not contain details of sector worked in, so we have linked back to wave 9 of the Understanding Society survey, which gives data on sector worked in in 2017 – 2019. It might be the case therefore that a minority of people will have moved sectors since then. Individuals were grouped into sectors using high level SIC 2007 codes, and sectors were further grouped to ensure that sample sizes were sufficient (with no group smaller than 50).

4. Results were weighted using the cross weights given in the Covid-19 dataset, which take into account basic demographics, household composition, economic variables and health variables.